How much can you earn on stocks on the stock market

Today, it is difficult to find a person who does not know that you can decently improve your financial condition on stocks. But not everyone knows exactly how to do this. To start making a profit and not lose money, you need to understand what stocks are, how they should be sold and bought, what are the trading strategies on the stock exchange, risks, and so on.

How to make money by trading stocks?

A share is a security that gives its owner the right to receive a certain part of the company’s income, as well as the opportunity to participate in the management process of this company.

Every enterprise needs cash for development and growth, which is why management uses the help of investors who invest certain financial resources in it. In return, investors receive a part of this enterprise in ownership and a corresponding percentage of profit. This percentage is usually called dividends. In addition, the owner of the shares can at any time sell their stake at a more favorable price for themselves.

To earn money on the stock exchange from scratch on purchased shares, you must::

- determine your goals, work out your strategy, and choose the right trading tactics in the market.Determining the timing will allow you to accurately predict the amount of profit and the period of its receipt;

- get specific knowledge and information about what stocks are, how to work with them, purchase and trade rules, and so on.In addition, beginners should definitely study information about brokers, exchange rates, stocks, issuers;

- identify possible risks.Before you invest your finances in buying shares, you should determine exactly the amount that you are willing to spend on it, but keep in mind that you may lose this money;

- choose a broker correctly, it can be a bank or a brokerage firm.Regardless of what you choose, the company’s activities must be licensed by the Central Bank.This is the only way you can be sure of safe cooperation.;

- you should buy shares after thoroughly studying all the necessary information, determining all possible risks and choosing a broker.At the same time, experts recommend choosing promotions only for those companies that are close to you and that you understand the work of.To reduce risks it is better to buy shares of several companies;

- constantly monitor the situation.If you have purchased securities and have not dealt with this issue for several years, then earnings on the stock exchange may be zero.Such investments require regular monitoring of price changes, market conditions, and the firm itself.In addition, it does not hurt to keep the state of affairs in competing companies under control.This will help you always be aware of what is happening and adequately assess the situation.

How much can you earn on the stock market?

The exact amount of earnings from trading stocks on the Internet and on the stock exchange depends on the financial capabilities of the investor and on the strategy of work. In addition, there are different approaches to making money on the stock exchange. Someone is engaged in trading, that is, speculating on stocks, and someone is investing. Depending on the approach to earnings, the investor’s income will also depend.

If you choose trading, then the statistics in this case leave much to be desired. A large number of traders lose their money, not understanding how to really make money on the stock exchange. If you are engaged in investing, then with a competent approach to business, the risks will be minimal and earnings on stock trading are guaranteed to you.

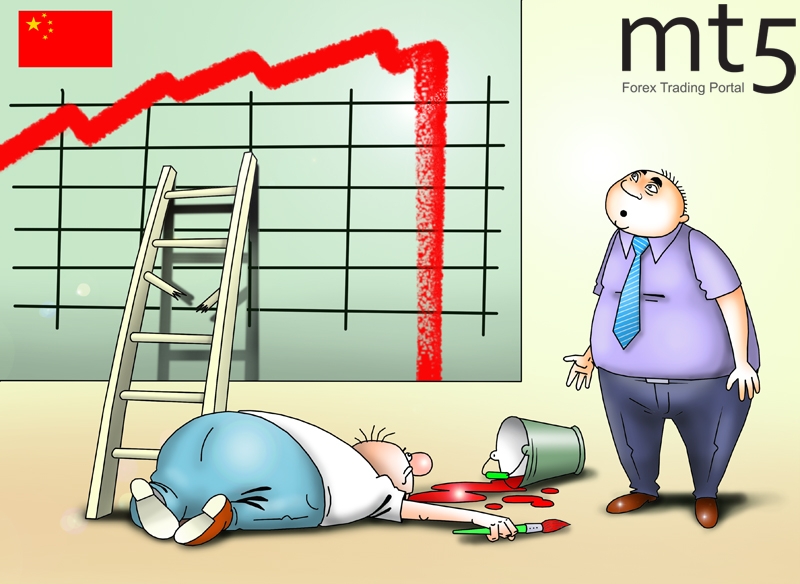

But it is necessary to take into account some nuances. Despite the fact that the stock market has an average growth rate of 10-11% per annum, it sometimes has recessions. For some stocks, the price may not change for years or fall. This means that you can make money online on the stock exchange, but the stock market is always a risk.

Is it possible to make money on the stock exchange on the fall of shares?

In the stock market, there is a concept of “game to lose”, the essence of which is that a trader can sell those shares that he did not buy. In this case, the trader, counting on a drop in the price of shares of a particular company, can borrow them from his own broker and sell them on the market at the current price. After some time, he will buy them back and give them to the broker. If during this period of time the price of these shares has decreased, then the trader will be able to earn, and if the price has increased, he will lose.

You can earn money on the stock exchange on the Internet in this way only if you have enough funds in your account to cover possible losses. The brokerage company carefully monitors such transactions. If the amount of possible losses exceeds the deposit amount, the transaction will be forcibly closed and the funds will be immediately debited from the account.

But earning money on the fall of a stock is not always possible, especially if you are an investor. Everyone who bought shares will benefit from a drop in their price. However, experienced investors can buy shares just when their value is falling, which can significantly increase capital when their value rises.

Traders often lose their profits on the sale of assets. The main reason for this can be called fixing losses in the hope of a rapid fall in the stock market.

A rather dangerous moment for those who make money on lower prices is the moment when most traders in this market segment close their trades at the same time. Such a situation in the market can provoke a sharp jump in prices in a short period of time.

How to make money on the stock exchange on dividends?

This option is used in the long run and is considered the most reliable among others. The essence of this option is that the investor collects his portfolio of shares of various firms and enterprises, becoming the owner of a certain part of each of them. Accordingly, in the future it has the right to receive from each company dividends ranging from 5 to 15 percent per annum.

In addition, each investor can sell their shares at a favorable price, above the purchase price, making a profit in the form of the difference between the purchase price and the sale price.

When choosing a way to make money on the stock exchange, it is necessary to understand that dividends are not a guarantee of stable and always predictable profits. The management team of any company can decide not to pay dividends, directing the funds invested by investors to improve their company.

Many novice investors are interested in the question-is it possible to make money on the exchange, using the transfer of investments in trust management? This option of making a profit can be compared with a deposit in a bank. The only difference is that the percentage of revenue can vary significantly both up and down.

The essence of this profit-making option is that the investor buys securities and transfers their management to the hands of an investment firm, which gets the right to dispose of them at its own discretion to make a profit. This type of strategy is best suited for the medium term.

How much do traders earn on the stock market?

The purpose of trading is to buy stocks at one price and sell them at a higher price. The resulting difference will be the trader’s profit. Many of them work online, buying shares virtually, without actually having them on hand. At the same time, transactions can be carried out in a very short time period with credit brokerage support. This strategy can be very profitable and profitable, and can also bring significant losses.

Shares of large enterprises and well-known firms with good returns and small dividends on the market are usually called “blue chips”. The profit of this investment option is low, but stable.

How to make money on the stock exchange?

To make a profit, each market participant needs to use different strategies, each with its own pros and cons. Earn money on the stock exchange is real, anyone who uses different opportunities can learn this.:

- training courses, programs, seminars, and video lessons will help beginners master the basics of trading on the stock exchange and teach them how to make a million dollars on the stock exchange;

- a lot of professional literature and training manuals have been published on this topic.The main rule for choosing educational literature is clear presentation of the material, specifics, and practical benefits;

- practice is the most ideal opportunity to work out your chosen strategy.To do this, the stock market provides demo accounts that will help you gain experience and not lose your own money;

- getting knowledge from a mentor broker.Today, almost every investment firm offers lessons for beginners and stock trading.But in this case, it is worth considering that the main purpose of such training is to attract customers.In such courses, as a rule, there is little information about possible risks, and the information may be presented in a distorted form.

If you decide to try your hand and want to understand how to make money on the stock exchange on the Internet, it is better to use several of the above options to get a versatile experience.

How much can you earn by trading stocks?

If we talk about newcomers to the stock exchange and consider the period from three months to six months, then the result of 3-5 percent can already be considered successful. In a shorter time, you can achieve any profit, in some cases beginners earn even more than professional brokers.

The fact is that a professional in the process of trading uses certain strategies, tactics with clear criteria for selecting shares, etc. And a novice broker does not yet have proven strategies, he can enter the market with all his deposit and, with a successful combination of circumstances, get one hundred percent profit.

In the same situation, a professional trader will enter the market with a smaller deposit, which will show the worst result in this particular transaction, but over a longer distance it will allow you to successfully bypass the novice.

Therefore, no one will give you specific and clear answers to the question of how much you can earn on the stock exchange.

When you are looking for answers to the question of how to make money on the stock exchange on the Internet, you need to understand that your profit depends on three main conditions: what exactly you came to the market with, where you came to, and what assets you will use.

Each broker comes to the market with its own resources and strategies, that is, it understands:

- how much finance can invest;

- how long is he willing to invest money?;

- what risks it can afford.

Next, you should consider where you came from. Today, there are quite a lot of investment markets, each with different options and earnings sizes. To choose a suitable market and understand how to make money on the exchange via the Internet, you need to determine for yourself:

- what is the current economic and political situation in the selected market?;

- analyze the percentage growth of this market over a year, three, or five years;

- evaluate the mood and experience of traders in this segment.

And the last group of conditions on which your earnings depend is the assets from which you plan your investment portfolio;

- evaluate the profitability of the selected companies;

- find out if these firms regularly pay dividends;

- evaluate the short-and long-term prospects of these businesses and the industries they belong to.

Your estimated earnings will depend on the total effect of these conditions.

If you plan to immediately start investing for a long period of 6 months to a year or more, and have stable stocks in your portfolio that are slowly but surely increasing in value, then you can get about 0.1-10 percent profit in a month. In this case, the risks of losses will also be minimal.

To make a good profit, you will need time for training and practical exercises.

Tips for beginners

If you are going to make money on the stock and financial markets – these recommendations are for you:

- do not invest all your money in one or two companies, make a versatile investment portfolio;

- allocate approximately 5-20 percent of the money invested to risky assets that have a high growth potential;

- you should not chase an instant high profit, your main goal should be a stable income for many years;

- if possible, invest regularly in your portfolio.;

- if you don’t know where to invest your money, choose large index ETFs;

- if you don’t want to use the resulting profit, invest in dividends;

- learn to adapt to the market.

Experienced traders also recommend not to be afraid to invest your free funds.

Those who plan to start making money on the market need to understand not only the options for making a profit, but also learn as much as possible about the existing risks.

No one will give you a guarantee of growth in stocks, they can remain at the same price level for several years. The investor in this case does not receive income, the exchange rate may fall so much that instead of earning money, he will suffer losses.

Not being able to control your emotions can also hurt the trader. Don’t get emotional about buying and selling assets.

Earning money in stocks and the stock market today is no longer a privilege of only a select few. Every adult can now become the owner of a brokerage account and start investing their own funds in shares of any company in the world. The profit potential in this case has no limits. The history of the stock market has such examples when an ordinary novice investor became a multi-millionaire.

The only thing that separates you from these people is that they were not afraid to take the risk and make the first step by investing their money in stocks on the stock market.

Leave a Reply