What are government bonds of Ukraine and how to buy them

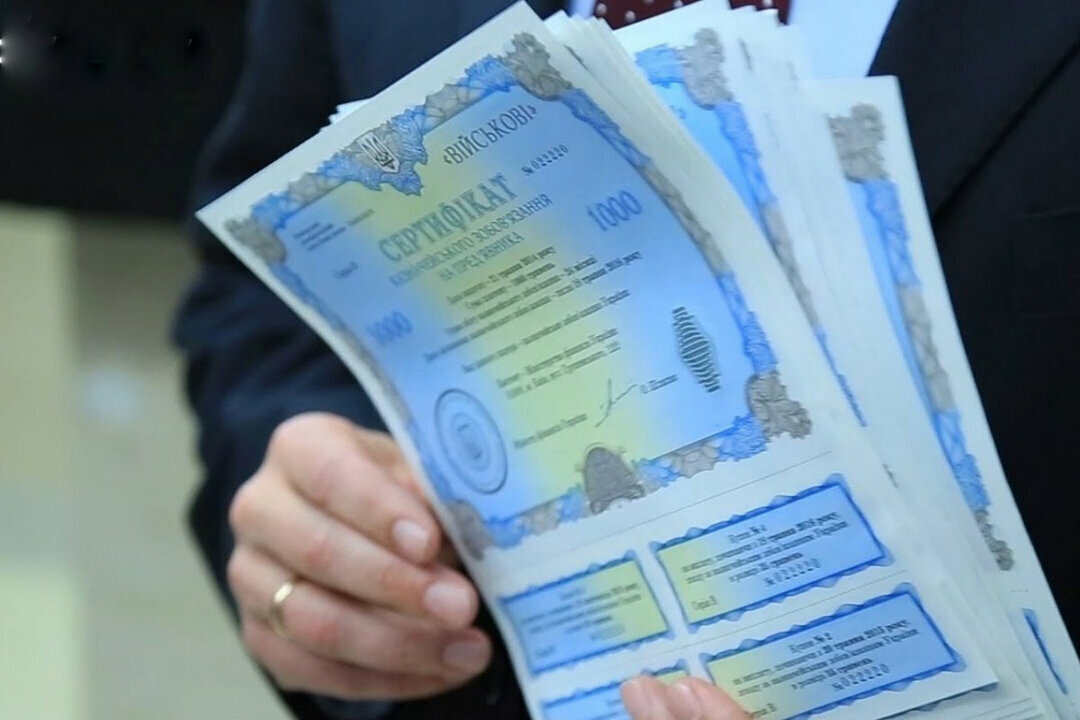

Government bonds, as well as treasury obligations, confirm the fact that the state receives funds in debt from an individual with the condition of repayment of the loan and remuneration at the agreed time. As a rule, this type of commitment is now issued in electronic form.

The issue of securities is considered part of the budget process. This means that all operations with bonds are carried out in accordance with the Budget Code, as well as in accordance with the Law of Ukraine “On the State Budget” for a specific date.

The issue of debt obligations is not controlled by the State Securities Commission, nor is it influenced by the stock exchange. The size of the issue is set by the Ministry of Finance of Ukraine and depends on the size of the national debt, both external and internal.

Government bonds are considered an alternative and reliable tool for saving and accumulating financial resources. The reliability of government bonds is higher than the reliability of a commercial bank deposit. In addition to the maximum reliability of government bonds, the advantages include preferential taxation. The investor pays only a 1.5% military fee. Also, the advantage of government bonds is their high liquidity, they can be easily sold at any time on the secondary market with minimal risks.

What are the types of Ukrainian bonds?

Currently, there are different types of government bonds, they differ in terms of placement, markets, goals, etc. For example, the terms of placement of bonds can be:

- short-term loans (up to 1 year);

- medium-term projects (1-5 years);

- long-term (over 5 years).

The placement period is the time at the end of which the individual will receive a full refund of the invested money. Interest on debt securities is usually accrued monthly or 1-2 times a year. In Ukraine, in addition to the hryvnia, there are dollar-denominated securities.

Why buy bonds in Ukraine?

Government bonds are securities issued by the state to address national requests. The National Bank of Ukraine is the custodian of the bonds. Currently, government bonds are the most liquid securities on the domestic market. In addition, they are seen as a profitable investment tool, which has a yield higher than that of any term deposit.

The coupon yield of the bonds is linked to the discount rate of the National Bank of Ukraine. If the discount rate starts to rise, the yield on government bonds will change accordingly. In addition, the profit on bonds is not subject to personal income tax, which means that the investor will not have to pay 18% of the profit, as in the case of term deposits.

The difference in the bond’s profitability in the national currency and in dollars is approximately 10 percentage points in favor of the former. Despite this fact, an individual’s investment portfolio consists of 75% of securities that are denominated in foreign currencies, in particular in dollars. This solution reduces the risks associated with devaluation.

Nowadays, banks offer investors various packages that start from 1000 hryvnias and 10 thousand dollars. For small investments, the associated costs associated with opening and maintaining an investment account reduce the overall return on investment. For this reason, bonds are the best way of internal investment for individuals who have free assets of more than 200 thousand hryvnias.

Financial analysts say that government securities have clear advantages. Firstly, the income on debt obligations is guaranteed by the issuer, and secondly, the remuneration is valid for the entire placement period. This means that the investor will receive his profit regardless of the situation on the stock market, foreign policy, the exchange rate of the national currency against the dollar, etc.

Which Ukrainian bonds should I buy?

Financial analysts recommend buying long-term bonds of Ukraine, for example, from 2023 with interest of 9-11% in the hryvnia, 4.7-5% in the dollar, 3-5% in euros. Transactions with government bonds, namely their purchase and sale, are carried out on the stock market. How do I buy government bonds? You will need to contact an investment company or a commercial bank.

Over the past few years, the population, attracted by high interest rates on deposits, has lost significant amounts of savings in insolvent commercial banks. Against the background of bank deposits, bonds look like a decent alternative for saving and increasing capital.

If you pay attention to the fact that now commercial banks everywhere reduce the remuneration on deposits, and also fix the interest on the deposit agreement for a period of less than 1 year, investing in debt securities allows you to get interest for 3 years, and not bad.

The only drawback of government bonds is the complicated purchase/sale procedure, which can be carried out with the help of a broker working on the stock exchange.

At the moment, the government bond market for individuals is developing very quickly. For potential clients, investment companies prepare favorable offers, as well as conduct various advertising campaigns in order to make this investment option accessible to a wide range of people.

Thus, bonds for individuals are an excellent way to manage their financial flows. Thanks to it, an individual gets additional opportunities for saving and accumulating capital.

Where can I buy Ukrainian government bonds?

The list of banking institutions that carry out operations with government bonds is published on the website of the Ministry of Finance.

However, when buying bonds, you should not forget about the existence of restrictions on the minimum entry amounts. The cost of one lot starts from UAH 1 million. At the same time, some investment companies practice selling government bonds for 1 piece in national currency and dollars.

Today, there are two options for purchasing government bonds, in particular in the primary and secondary markets. Second-tier banks are primary dealers, and they purchase bonds at the request of an individual. In the primary market, operations are mainly carried out with large lots, which start from 1 million hryvnia.

Individuals who are interested in small lots should buy government bonds on the secondary market. Government securities can be purchased from merchants or on the stock exchange. If you prefer a bond merchant, you will need to enter into a contract with them. The merchant will open an account for the individual, then register it on the exchange.

Although an individual is exempt from taxes on income from securities, a private investor will need to pay commission fees to intermediaries. If the merchant is also a custodian, then commissions will be minimal. Government bonds are an excellent alternative to deposits, which allows you to diversify your financial investments.

How to buy bonds to earn money?

Naturally, the remuneration on government bonds is not so high compared to risky investment instruments. This is due to its guaranteed profitability. This means that if you want to make more money, you need to buy more debt securities. For serious investments, you will need about 150 thousand hryvnias and above.

The algorithm for investing in bonds is very simple. You need to find the most favorable investment conditions. Decide in advance on the currency, period, and intermediary. Then you need to show up at the bank or investment company with your passport and identification number. Enter into an agreement with the bank. After that, you need to show the sources of income for purchasing government bonds. You can do this by presenting a salary certificate or income declaration. A securities account will be opened in your name, where you will store your bonds. It remains a small matter-to make a payment for government loan bonds, pick up an account statement. Since the state is the guarantor of repayment of the nominal value and coupon income, this type of securities is considered almost risk-free.

Currency bonds of Ukraine

Government bonds in foreign currency, according to potential investors, have the following advantages::

- high yield;

- 100% repayment guarantee.

In addition, the advantages include the fact that when investing in foreign currency bonds, the owner of the capital independently determines the term of deposit placement. The maximum validity period of the bond is up to 3 years. If the owner of the funds wants to return their savings early, they can sell the bonds on the secondary market.

However, if you take a closer look at the advantages, it becomes more of a disadvantage. Why? In case of an early sale, the investor will have to pay a commission to the depository for performing the operation of debiting the debt paper from the investment account. A foreign currency bond is sold only for the national currency, and not all investors like it. When selling the bond, you will need to pay the appropriate taxes.

Profits on foreign currency government bonds are subject to taxation, and the depositor must take care of paying the tax himself. An investor is exempt from taxes only if he waits for the bond placement term to expire.

The disadvantage of currency bonds is the complexity of the method for a simple person. A deposit is a more understandable and simple type of investment for the population, but only a small part of it knows about securities trading.

Leave a Reply